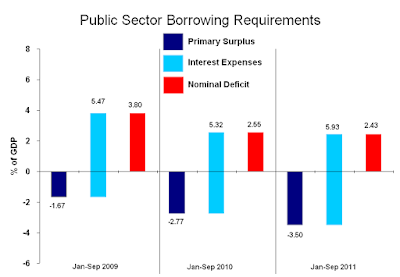

The Brazilian "FOMC" announced today the new basic interest rate (Selic). The Selic rate dropped from 11.5% to 11%, the third consecutive fall. The Central Bank has signaled that the process of falling interest rates would be "moderate", and therefore, the rate was in line with the market forecast. However, the worsening in international crisis and the slowdown of domestic activity is leading the market to predict further falls in interest rates. Today, the future yield curve is consistent with a fall of 1.5% divided between the three forthcoming meetings of Comittee of Monetary Policy.

Despite this fall, interest rates in Brazil are still among the highest in the world.

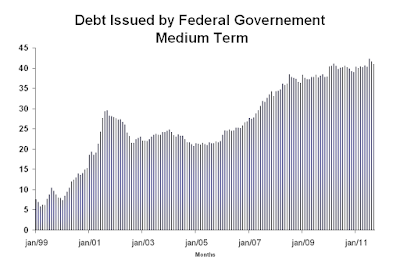

|

| Source: Central Bank of Brazil |