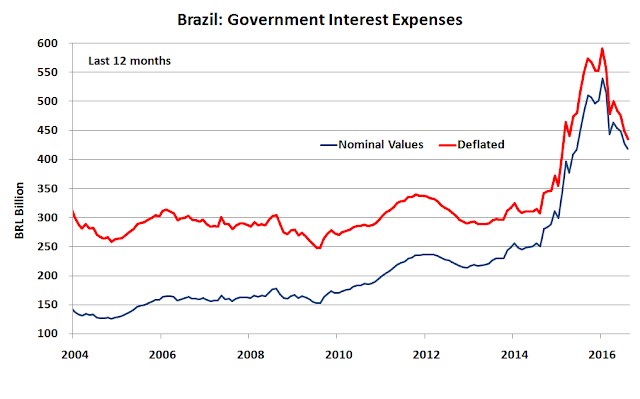

Brazil: Expenses with Interest Payments of the Public Sector

The real interest rates in

Brazil have always been among the highest in the world, and this is reflected

in government disbursements for the payment of public debt costs.

As we can see in the chart,

government spending with the payment of debt interest fluctuated in today's

values between BRL 250 and BRL 350 billion between 2014 and 2014, and

accelerated from the end of 2014, with a peak close to BRL 600 billion in early

2016, and then was reduced for BRL 435 billion in August 2016.

|

| Source: Central Bank of Brazil |

The acceleration of interest

expense coincides with the increase in public debt (see post here).

The prospect is that real

interest rates in Brazil will fall, as has occurred in major economies of the

world. A lower rate of interest should reduce the need for government to pay

interest in the medium term, but in the short term, the costs must also reflect

the high interest rates of the current stock of government securities.